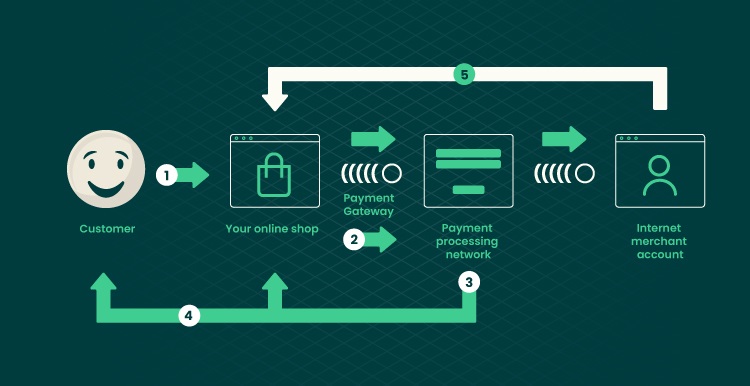

Payment gateways are vital to the fast-moving world of e-commerce because they facilitate easy transactions between customers and companies. On the other hand, these gateway fees may have a big effect on how profitable internet businesses are. Owners who want to maximize revenues while maintaining a great client experience must comprehend payment gateway costs and how they affect e-commerce firms. Knowing what is a gateway fee is essential here.

Comprehending Payment Gateway Charges

E-commerce companies must pay payment gateway fees in order to execute online purchases. A setup fee, monthly fees, transaction costs, and sometimes extra fees for chargebacks or overseas transactions are included in these expenses. Depending on the payment processor, transaction fees may vary from a fixed rate per transaction to a percentage of the transaction value. Since e-commerce companies often have slim profit margins, even a little portion of revenue lost to gateway fees may hurt overall profitability.

Effect on Earnings Percentage

The total impact of payment gateway costs may be substantial for e-commerce companies, especially for new and small- to medium-sized firms (SMEs). Excessive transaction costs may take in a large portion of revenue, which lowers profit margins. Furthermore, the price of using gateways to process payments rises in tandem with sales volume. This higher overhead may force companies to reevaluate their pricing policies or make sacrifices in terms of product or customer service quality, both of which might be detrimental to the long-term image of the brand.

Techniques for Reducing Fees

E-commerce companies may use a number of tactics to reduce the effect of payment gateway costs without compromising the quality of service provided to customers. Finding the payment gateway company that provides the most affordable billing plan requires careful comparison shopping. In order to choose a provider that fits their sales volume and average transaction size, merchants should examine their transaction trends. For example, flat fees may be less expensive than percent-based fees if a firm has a high average order value.

Utilizing a Variety of Payment Methods

Providing a variety of payment alternatives is another successful tactic. Despite the fact that it can seem paradoxical, offering a variety of payment options sometimes results in cheaper processing fees. Conversion rates may be raised by satisfying customers’ preferences for certain payment methods, which can improve their purchasing experience. Additionally, some payment methods could have reduced processing costs, enabling companies to deliberately steer clients toward certain choices.

Haggling over Fees with Suppliers

Additionally, e-commerce companies have to think about haggling over costs with payment gateway suppliers. Talks are welcome with many providers, particularly those who work with companies that have a strong amount of transactions. Merchants may be able to get a lower transaction rate or no monthly costs by signing a longer contract or combining all payment processing under one supplier. These kinds of talks may increase revenue without requiring adjustments to the client experience.